Why Asset Managers Should Allocate to Bitcoin in 2025

Strategic allocations to bitcoin can improve long-term portfolio performance and risk-adjusted returns, while hedging against currency debasement.

In today’s macroeconomic environment, allocating to sound money assets – gold and bitcoin – is particularly compelling due to unsustainable national debt to GDP levels and the resultant necessity for monetary expansion in order to service those debts.

Global debt-to-GDP ratios have soared in recent years, with major economies like the US exceeding 120% and Japan surpassing 250%. Governments and central banks, facing limited fiscal headroom, are forced to continue expansive monetary policies over the long term, ultimately with increased borrowing and quantitative easing driving money supply growth. The US M2 money supply has grown by over 40% since 2020.

This structural driver for money-supply expansion causes currency devaluation, eroding the purchasing power of fiat currencies and the real returns of traditional portfolios, especially fixed income. Sound money assets, with their inherent scarcity – gold’s low supply inflation rate and Bitcoin’s 21-million-coin cap – offer a hedge against these pressures. A modest allocation to bitcoin can help position investors to hedge currency debasement and sovereign debt crises.

Source: Capital Group, Congressional Budget Office February 2024 report.

Institutional adoption

BlackRock and Fidelity have emerged as pivotal players in the institutional adoption of bitcoin, launching US spot bitcoin exchange-traded funds (ETFs) in early 2024 to provide regulated, accessible exposure to the asset for both retail and institutional investors.

BlackRock's iShares Bitcoin Trust (IBIT) was the most successful ETF launch in history and has rapidly accumulated $88 billion in assets under management (as at September 2025). BlackRock's CEO Larry Fink has publicly emphasised bitcoin's role in traditional portfolios, with the firm expanding its offerings to include advisory on bitcoin integration. Similarly, Fidelity has deepened its commitment through comprehensive crypto outlooks, viewing bitcoin as a transformative asset class.

Regarding portfolio allocation recommendations, BlackRock advocates for a modest 1-2% exposure to bitcoin in traditional portfolios to enhance risk-adjusted returns without significantly amplifying volatility, based on their analysis of Bitcoin's low correlation with stocks and bonds. Fidelity, in its institutional insights, suggests allocations of 2-5% (potentially up to 7.5% for younger investors) to capitalise on Bitcoin's potential for outsized positive impacts, particularly in retirement and diversified strategies.

Nation state adoption

The enactment of the US Strategic Bitcoin Reserve (SBR) via executive order on 6 March 2025 represents a landmark development in nation-state adoption of bitcoin, solidifying its status as a strategic reserve asset akin to gold or oil. Signed by President Trump, the order establishes the SBR within the Department of the Treasury, capitalised with over 207,000 bitcoin. This move centralises federal bitcoin holdings, prohibits their sale to maximise long-term value, and authorises budget-neutral strategies for acquiring additional bitcoin without taxpayer costs, positioning the US as a leader in bitcoin adoption. This executive action signals to global markets the asset's legitimacy as a hedge against economic instability. For asset managers, the SBR's implementation underscores bitcoin's growing institutional and sovereign appeal, reinforcing the rationale for portfolio allocation.

Why bitcoin over gold?

There is space for both assets within a portfolio, but the growth opportunity is potentially greater for bitcoin than for gold because of bitcoin’s superior monetary attributes combined with its relatively small size: gold is 10 times larger at $18 trillion vs bitcoin’s $1.7 trillion. We believe gold will continue to appreciate in fiat terms over the long term, but that ultimately bitcoin will overtake gold as investors flock to the hardest form of money with the best functionality. For asset managers, early allocation to bitcoin and related securities offers exposure to a high-growth sector, akin to investing in the internet during its nascent stages in the 1990s.

The table below grades bitcoin, gold and fiat money (such as dollars):

Source: The Bullish Case for Bitcoin, Vijay Boyapati, 26 February 2018, https://nakamotoinstitute.org/mempool/the-bullish-case-for-bitcoin/

“Pristine collateral”

Bitcoin earns the moniker "pristine collateral" because of its distinct characteristics. Unlike traditional assets like real estate or stocks, which can be encumbered by legal disputes, counterparty risk, liquidity issues or jurisdictional complexities, Bitcoin operates on a decentralized blockchain, ensuring transparency, immutability and global accessibility. Bitcoin’s divisibility and transferability allow it to be used seamlessly as collateral for lending without intermediaries. Additionally, its censorship-resistant nature protects it against seizure or manipulation by governments or institutions, enhancing its appeal as a secure, unencumbered asset. Bitcoin is a versatile and liquid asset to transfer and borrow against, reinforcing its role in modern asset allocation.

Diversification benefits

Bitcoin can sometimes be uncorrelated with, or have a low correlation to, traditional asset classes like stocks, bonds and commodities. Historical data shows that Bitcoin’s price movements often diverge from those of equities and fixed income. For instance, during the equity market sell-off in early 2020, Bitcoin demonstrated resilience, recovering faster than many traditional assets. This low correlation can reduce portfolio volatility and enhance risk-adjusted returns.

How funds can allocate: bitcoin-backed securities

Beyond direct investment in bitcoin or bitcoin ETFs, which some pools of capital such as equity and fixed income funds may not have a mandate to own, asset managers can now participate in the growth of bitcoin by owning a variety of bitcoin-backed securities.

The best and purest options in our view are the equities and fixed income instruments issued by bitcoin treasury companies.

Strategy (MSTR) has issued convertible bonds and, in 2025, four publicly listed preferred equities (STRK, STRF, STRD and STRC). The preferred equities are high-yield perpetual fixed-income instruments that are capable of boosting the yields and returns of fixed income allocations.

Strategy’s business model is to increase its bitcoin per share by harvesting premiums from packaging bitcoin exposure into securities aimed at different investor profiles. The company sells the securities to add bitcoin to its balance sheet, thus increasing its collateral backing the products and capturing a premium or “yield” for the common shareholders in the process.

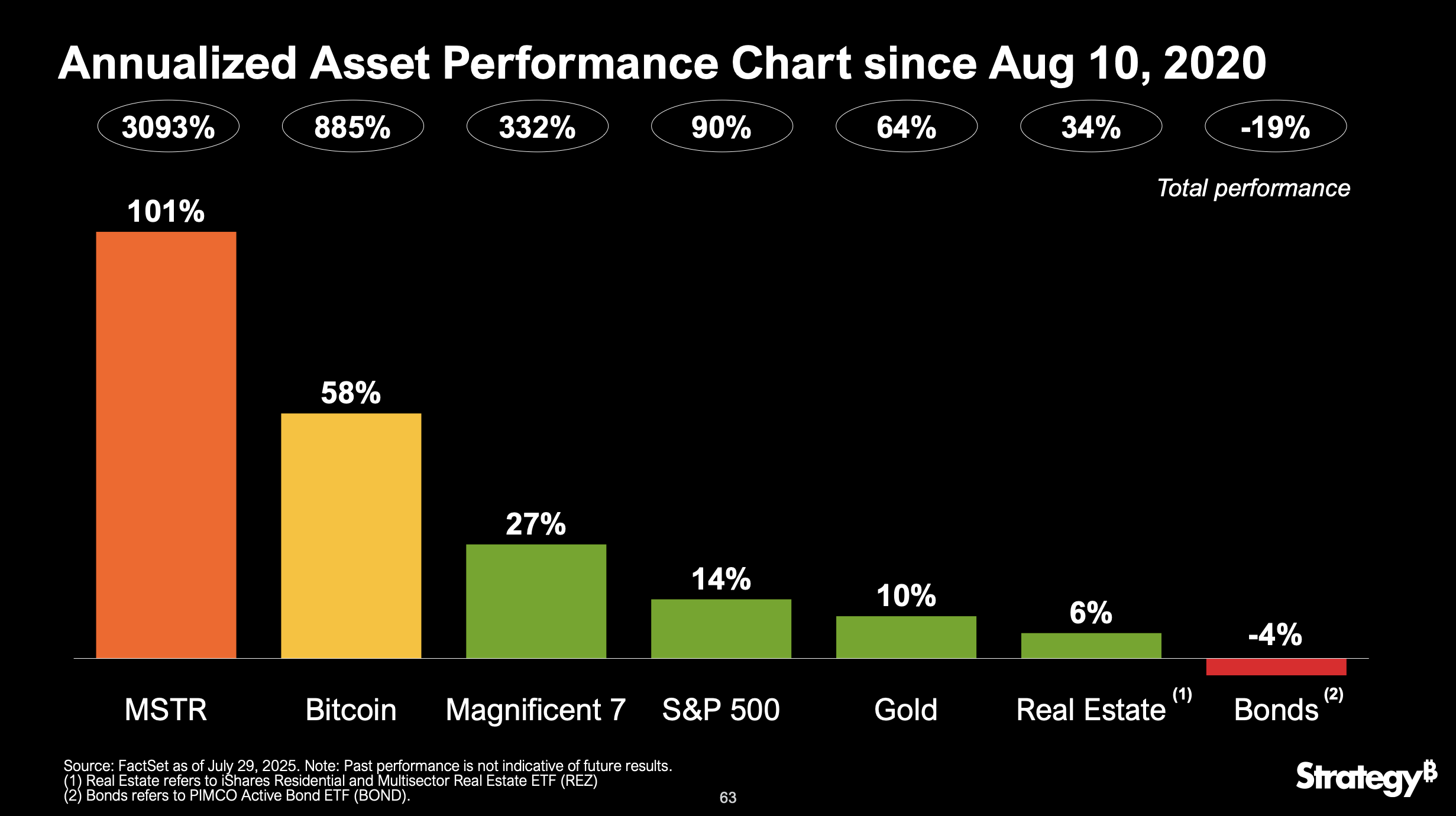

Because the company has access to leverage and it can sell convertible bonds at a convert premium on top of the share price, it is reasonable that the equity will continue to command a premium over its bitcoin per share. Selling the equity and buying bitcoin is then accretive to common shareholders, and selling the convertible bonds is more accretive. Therefore, the common stock (MSTR) has outperformed bitcoin since it adopted its bitcoin treasury strategy in 2020, as the bitcoin per share has grown as well as the bitcoin price.

Source: Strategy Q2 2025 Financial Results presentation, 31 July 2025 https://assets.contentstack.io/v3/assets/bltf8d808d9b8cebd37/blt3758ba103764912f/688cf843a168ff712977f926/q2-2025-strategy-earnings-presentation.pdf

Strategy is now mostly emphasising its preferred equity products, which offer varying degrees of bitcoin exposure with downside protection. Bitcoin’s long-term growth rate – which we believe will gradually slow but remain higher than that of any other asset class for the foreseeable future – allows for the issuance of these high yield securities to be accretive for common shareholders while also offering superior fixed-income returns to the preferred shareholders. These securities are currently over collateralised; in our view, some of them should be rated investment grade (STRF) and they are therefore mispriced. STRK offers an 8.6% effective yield (15 September) while also having an option to convert to common equity.

Several companies are following in Strategy’s footsteps, aiming to securitise bitcoin into instruments that are attractive to different pools of capital in their respective markets, for example Metaplanet (3350.T) in Japan and The Smarter Web Company (SWC.AQ) in the UK.

Over the medium to long term, bitcoin-backed fixed income instruments will act to pump capital from fixed income allocations into bitcoin, further supporting the growth of the asset class.

The future of bitcoin in asset management

As the global financial system continues to evolve, bitcoin and bitcoin-related securities are poised to play an increasingly prominent role. Institutional adoption is accelerating, with major players like Fidelity and BlackRock recommending bitcoin exposure as part of a typical portfolio allocation. Regulatory frameworks are also maturing, providing greater clarity and confidence for investors.

For asset managers, ignoring bitcoin risks missing out on a transformative opportunity and being over-exposed to the risk of fiat debasement. By allocating to bitcoin and related securities, portfolios can benefit from higher risk-adjusted returns, protection against currency crises, diversification and exposure to a high-growth sector, akin to investing in the internet in the 1990s.

Incorporating bitcoin exposure into traditional portfolios is no longer a speculative endeavour but a strategic necessity. As stewards of clients’ wealth, asset managers must embrace the potential of bitcoin to enhance returns, manage risks and stay ahead of the curve. At Equity Edge Studio, we stand ready to guide our clients through this exciting evolution in finance, delivering the insights and solutions needed to thrive in a digital-first world.

Disclosure:

The writer owns shares in STRK and SWC.AQ at the time of writing.

Disclaimer:

This article is for informational purposes only, does not offer investment advice and does not recommend the purchase or sale of any security or investment product.